MEMECOIN MANIA TAKES OVER CRYPTO!

If you’ve been even half following the digital asset space over the last month or so, you’ll no doubt already be aware of the extraordinary gains that some of the so-called meme coins have been making.

But in case you’re still blissfully unaware: firstly, congratulations; and secondly, meme coins (tokens that are based purely on their implied association with memes, and which have literally zero intrinsic value or utility) have been outperforming serious crypto projects such as Bitcoin (as well as everything else in both crypto and the real world, including Nvidia stock) by an extremely wide margin.

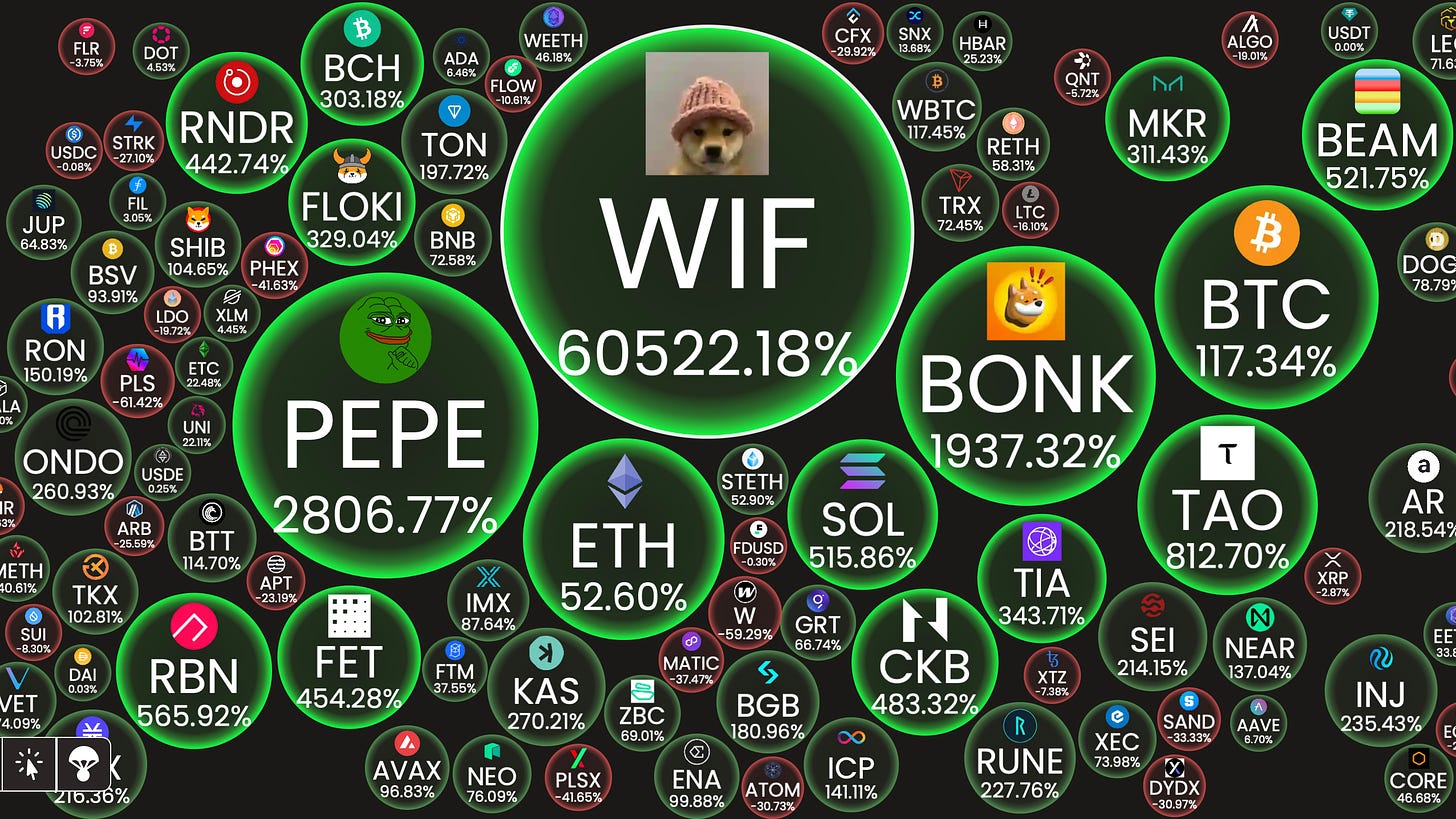

To give you a feel for the scale of the recent mania: one such meme coin, called Dogwifhat - which was launched late last year and is based purely on its association with a picture of a dog wearing a hat - is up over 60,000% since launch. In fact, it was up over 80,000% until a recent ‘pre-halving’ crypto selloff, which was further exacerbated by escalating tensions in the Middle East.

That means that if you’d been degenerate enough to put $10k into Dogwifhat at the tail end of last year, you’d now be a multi-millionaire (sitting on profits of approximately $6 million at the time of writing). Of course, that’s if you had the fortitude to cash out somewhere near the top — and the guts to have ridden it all the way up in the first place. But make no mistake: it’s not an abstract proposition — fiat millionaires are definitely being made. Like clockwork.

And whilst Dogwifhat (or “wif” as it is colloquially known on account of its ‘ticker symbol’) is undoubtedly a stellar performer in the emergent meme coin space, it’s not exactly an outlier. The reality is that dozens of other such meme coins, including the likes of PEPE, BRETT, FLOKI, PUPS and BONK have also printed percentage gains that increasingly look like computer output errors, as we head deeper into the bull market and millions of retail ‘investors’ flood in to take a punt on memes — hoping to get their slice of the ‘get rich quick’ pie at the meme coin casino…

MEME COINS: CRYPTO’S DRUNK UNCLE CRASHES THE BULL RUN

Now, at first glance, it’s easy to dismiss all of this hype as yet another gigantic crypto dumpster fire. Certainly, to the casual observer, it’s merely the latest round of tulip mania in an industry already known for its reality distortion field, and its irrational, reflexive, greed-induced, parabolic excesses.

Indeed, to many within the crypto industry itself, meme coins are increasingly regarded as a complete embarrassment. For this ‘serious business’ cohort, meme coins are perhaps crypto’s equivalent of a drunk, racist uncle, turning up unannounced at your wedding, and proceeding to flame-throw whiskey out of his mouth in an effort to impress the bridesmaids — before breaking all of the furniture into tiny splinters, as your new in-laws look on in horror.

And the timing of his arrival on the scene couldn’t be much worse, just as crypto has finally begun to rebuild its tarnished reputation after a rocky couple of years — having already suffered some serious setbacks for unwittingly lionising grifters such as Do Kwon and Sam Bankman-Fried.

And so, it was against this gloomy backdrop that the Bankless podcast lads recently asked, “Has Crypto Lost The Plot? WTF Are We Doing?” (as well they might). They referenced a blog post, entitled Crypto’s Broken Moral Compass, in which someone who goes by the name of Polynya announced their departure from the crypto scene (for good this time, whatever that means) — on account of their utter disgust at the meme coin frenzy and what it portended for the digital asset class. The recent emergence of a pernicious trend in racist meme coins was, for this crypto OG, clearly the final straw.

Anyway, at the time of reading said blog post, I completely understood Polynya'’s frustration. Permissionless environments - where anyone can spin up anything - come with significant overheads, as we already know from some of the stuff that happens on the internet proper (e.g. on the dark web). And initially, I found myself firmly aligned with this camp — i.e. believing that meme coins are making a complete mockery of crypto and everything it stands for.

After all, convincing people that crypto actually does stuff and is a transformative, democratising technology (as has been my want for several years now) is a tough enough slog without being repeatedly undermined by participants operating within the industry. And let’s face it: we’ve all had enough of crypto’s propensity for self-harm, given what went down in 2022 — with the collapse of TerraUSD and the unravelling of FTX.

Certainly, I don’t doubt that meme coins (especially of the recent racist variety) are doing very little to strengthen crypto’s reputation, especially amongst the political class — many of whom are dying for yet another excuse to slam the brakes on crypto. Indeed, I’m sure it’s only a matter of time before Elizabeth Warren or someone else on the hill starts organising hearings and making political capital out of meme coins, which will undoubtedly be characterised as the latest hateful, criminal cowboy bonanza to infect the world of crypto.

So, in an effort to explain this seemingly boundless clusterfuck to myself, I reached for something that the late-great comedian and political satirist, George Carlin, once said: “never underestimate the power of stupid people in large groups”.

That pretty much nailed it for me. It tied up a lot of loose ends: lots of stupid people, moving in unison, a motley ship of fools, unwittingly providing the exit liquidity for the next generation of crypto-savvy narcissists, who are engaged in playing a highly profitable, zero-sum game against a bunch of clueless retail investors — the vast majority of whom will lose everything they put in (barring perhaps fractions of pennies on the dollar).

And as for the racist side of things? Well, that’s simply the ‘cryptofication’ of what Sacha Baron Cohen does so well in real life — exposing the low IQ banality of racism everywhere it rears its ugly head. Except this time, there’s a record of all the participants, on-chain, forever.

But why the huge surge in attraction to meaningless meme coins in the first place?…

WHY ARE THEY BUYING IT?

Well, it’s a perfect storm of sorts. Firstly, the mainstreaming of this trend has been held at bay to some extent by network bandwidth problems (e.g. on Ethereum), where blockspace is at a premium. But the increased adoption of lower cost chains such as Solana and Base (Coinbase’s new Layer 2 chain, built on top of Ethereum) has made meme coins more popular and accessible, since people can trade in and out of them without incurring exorbitant gas fees — making the meme coin casino much more accessible than in previous cycles. This is one of the main reasons for the sudden explosion in interest — the user experience (UI/UX) on these newer chains is much better, and people can put $50 into a meme coin without losing half of it in gas fees every time they perform a transaction.

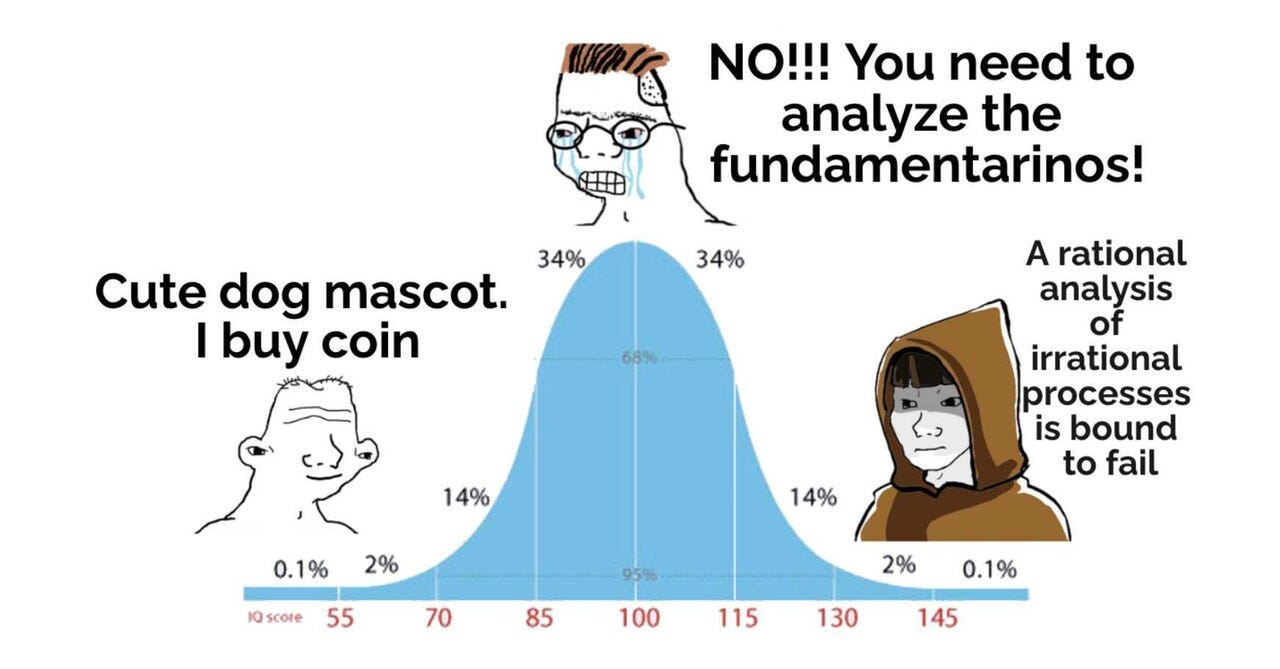

Genuine crypto projects (with actual utility) are also way too complicated for the majority of people outside of the industry to understand. Plus, the financial dynamics surrounding many of the serious projects are typically swung in favour of VCs and other insiders. There’s seldom such a thing as a fair launch. So, by the time retail investors get a piece of the action, much of the juice has already been squeezed out. And when you boil it all down: “coin has dog” is a much easier concept to grasp than grappling with the white heat of “zero-knowledge proofs” (ZKPs) or “automated market makers” (AMMs).

At least with meme coins, you know where you stand — absolutely nowhere. Either you like the dog (or the cat, or the frog, or whatever the fuck the next golden moonshot ticket is) — or you don’t. And that is all you need to know to make an informed decision concerning your participation. It’s the equivalent of betting on a horse because you like its name — it’s just a bit of a flutter. You win some, you lose some. No need to scrutinise the fundamentals, or the roadmaps, or the white papers — because there aren’t any. It’s a bet on a three-legged horse running in a meme culture derby alongside a crowded field of other three-legged horses. It’s that simple.

Yay! Now, do you like that doggie in the window or not?…

A GANGSTER’S PARADISE

As for the grifters who want to indiscriminately fleece people from the comfort of their faux leather gaming chairs, this sudden surge in interest in meme coins is like manna from heaven. Because if you’re launching a meme coin, there is no need to pretend to promise anything by way of deliverables — other than some vague message alluding to the fact that “it’s just a bit of fun”.

You can spin up a new meme coin in a New York minute if you know what you’re doing, with very little effort or capital — and you’re much less likely to land yourself in hot water when it comes to all the complex legal stuff that Gary Gensler repeatedly gets his thong in a twist over. No need to worry about investment contracts and the various prongs of the SEC’s holy grail, the antiquated Howey Test — because none of that stuff applies to goofy tokens that point nonchalantly at viral internet memes.

GENUINE CRYPTO PROJECTS ARE AN IMPENETRABLE YAWN-FEST

Moreover, serious projects, such as Cardano, are dull enough to induce narcolepsy in the average punter — plus they don’t offer the kinds of returns that crypto has become famous for. In fact, in many cases, they act more like stable coins. And let’s face it: retail investors who feel like they missed out on Bitcoin aren’t here for the crumbs left on the table, or even for doubling or tripling their money (gains that would be considered explosive in the world of TradFi) — they’re here almost exclusively for the moonshots. And meme coins definitely offer that moonshot potential, even if it ultimately proves illusive for the vast majority of people.

A LACK OF HUMAN INTELLIGENCE

I initially felt satisfied with this general conclusion - that the whole thing boils down to stupid people being repeatedly exploited as exit liquidity by grifters in a zero-sum game expressly designed to fleece the naive retail investor - and accordingly shortened my timeline for achieving artificial general intelligence (AGI) by 18 months. Not on the grounds of any new technological breakthroughs, or leaks from OpenAI, you understand — but purely because the human intelligence benchmark itself (against which AGI must ultimately be measured) needed to be substantially reduced in order to account for a timeline that included the deeply irrational, runaway success of meme coins.

HAVING SECOND THOUGHTS

But then I paused to reflect for a moment, as I remembered an old idiom that I occasionally use as a touchstone to keep me from arriving at comfortable conclusions in haste. It’s an idiom that is often attributed to Einstein (as all good idioms seem to be these days, at least the ones that aren’t attributed to Benjamin Franklin), which states that: “condemnation without investigation is the height of ignorance”.

So I decided to investigate. And having investigated further, at the very least, it turns out that writing off meme coins in this fashion is a classic case of “mid-curving it” — in terms of both their financial potential and longevity, and their cultural significance.

Alas, like so much else in life, the success of meme coins is not contingent on whether or not I happen to like them.

Of course, nothing outlined above should be entirely discounted. These concerns are all legitimate. It’s just that it’s not the whole picture, not even close. It’s lazy thinking. And it’s tone deaf in the same way that neoliberalism is tone deaf — well dressed, but kind of smug, self righteous and out of touch with reality.

Meme coins cannot simply be written off as the latest crypto shitstorm by earnest people who think they know best. Because they don’t. In fact, they almost never do — because they see the world through the prism of their own confirmation biases, and therefore don’t take the time to actually put the work in.

That’s my headline conclusion, having spent the best part of the last six weeks embroiled in a much deeper investigation into this fever-pitched, incredibly messy, volatile, rapidly expanding and increasingly hard to ignore crypto phenomenon called meme coins.

There’s a lot to unpack here in terms of presenting the flip side of the “meme coin bad” argument — so let’s dive in…

MEMES: THE NATIVE LANGUAGE OF THE INTERNET

In the digital age, if data is the new oil, then memes are the new universal language — the equivalent of internet’s own lingua franca. This isn’t immediately obvious to people who forged their social identities in meatspace last millennium (let’s say for people over the age of 35). But for people who don’t remember much about the world before the dawn of the smartphone - digital natives, living their best lives primarily in the online attention economy - memes and meme culture rule supreme. And we can’t even begin to unpack meme coins without first unpacking the significance of memes. So let’s start there.

The evolutionary biologist Richard Dawkins is credited with coining the term "meme" in his book, The Selfish Gene, which was published in 1976. The term is derived from the Greek word "mimeme" — meaning "that which is imitated”. Whilst it sounds somewhat implausible, Dawkins first introduced the concept of memes as cultural units of information, which are transmitted and replicated through imitation — similar to the way genes are transmitted and replicated through biological reproduction. Since then, the term "meme" has been widely appropriated to describe various cultural phenomena, especially those that spread rapidly through online channels.

The concept of internet memes began with the growth of online communities during the 1990s. Initially, memes were simple concepts or catchphrases that circulated within niche online communities. But with the rise of forums, image boards, and early social media platforms such as MySpace and Facebook (alongside the rollout of broadband connectivity), memes rapidly started to take on a more visual form. All Your Base Are Belong to Us and Dancing Baby are early examples of online memes that went viral during the early years.

By the mid-to-late 2000s, with the emergence of platforms such as 4chan, Reddit and YouTube, memes proliferated and diversified rapidly. Image macros (images overlaid with text) became a particularly popular format — spawning memes like Rage Comics, Advice Animals and (one of my personal favourites) LOLCats.

By the 2010s, internet memes had become a mainstream cultural phenomena — often crossing over into offline spaces. Social media platforms such as Twitter, Instagram and TikTok further accelerated the spread of memes and meme culture, with formats evolving rapidly to reflect changing cultural and technological trends.

And just for the record: the aforementioned runaway success of the Dogwifhat meme coin project wasn’t exactly a happy accident: it owes the lion’s share of its success to a hugely popular meme that went viral back in 2019.

“Is a song a hit if it is trending on YouTube? What if it becomes associated with a TikTok meme? The idea of radio plays and selling songs just doesn't hold the same water as it used to.”

Harry Enten

Memes have become a new form of cultural currency, allowing individuals to engage with and comment on current events, popular culture and societal trends in a humorous and relatable manner. They often emerge within specific online communities and serve as a means of bonding and identity formation. Communities rally around shared memes, creating inside jokes and fostering a sense of belonging.

And much like traditional languages, memes are truly participatory — anyone can play. They provide a platform for individuals to express their creativity and humour within the constraints of a predefined format. Remixing and riffing on existing memes is a common practice — leading to the creation of new and often unexpected variations.

And perhaps most importantly in relation to the recent explosion of meme coins: as the native language of the internet, memes literally thrive on virality — they are expressly designed to spread quickly across online networks. To return for a moment to the biological origins of the term: the virality of memes is baked into their DNA. And modern social media platforms based on ‘short-form’ visual content increasingly amplify this process — allowing memes to reach vast audiences within very short periods of time.

THE ‘EVERYTHING' PONZI & THE RISE OF FINANCIAL NIHILISM

In case you hadn’t noticed, we’re rapidly approaching the point where society itself could be best described as a Ponzi scheme. The United States, for example, at least on its current trajectory, hasn’t a hope in hell of keeping up with payments for its social welfare system. And in Europe, baby boomers are likely to be the last generation that can expect meaningful state pensions. Forget the cries of “crypto is a Ponzi” — because these days, literally everything, including the US dollar, is a Ponzi scheme.

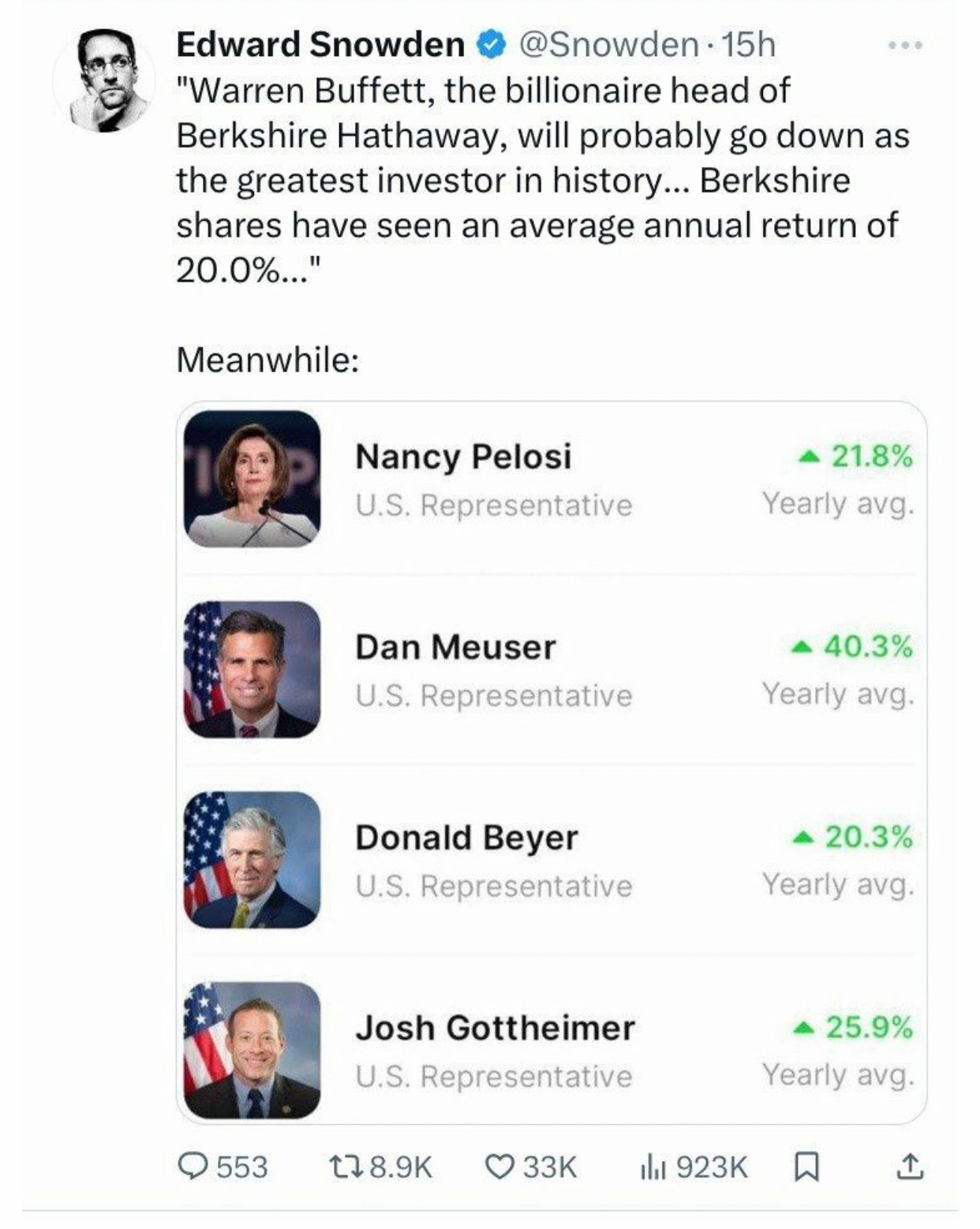

Meanwhile, we are either being governed (seemingly to the point of extinction) by a plutocratic gerontocracy, replete with its bipartisan ‘crocodile-smile’ stormtroopers (as in the United States); or by a shower of insincere, corrupt, metrosexual snake oil slime balls (as in the UK, France and Canada).

The vast majority of people below the age of 35 will never be able to afford to their own homes. According to the WEF, they’ll own nothing and be happy — or else. Many of them can’t even afford to rent. And it’s not just in the west: young people in China are increasingly adopting a “let it rot” - or “bai lan” (摆烂) - attitude to life. I could go on, but you get the picture. The disparities between rich and poor have already reached desperate proportions — and they’re getting worse with each passing year.

At the heart of this strife is one great leveller: whether or not you already own financial assets (including real estate). If you don’t, you’re screwed. Your purchasing power is deteriorating rapidly (much more rapidly than the stated government numbers), your wages are going nowhere fast, and you don’t get to benefit from the upside of owning assets that are going up and up (largely because they’re denominated in a currency that is being debased away to nothing).

Against this insufferable backdrop, we are witnessing the emergence of a new trend towards financial nihilism — one definition of which is “a philosophy that treats the objects of speculation as though they were intrinsically worthless”. And meme coins are de facto tokenised objects of speculation that are intrinsically worthless. Now do you suppose that’s a coincidence?!

If one had to pick a single moment that this concept of financial nihilism crossed into the realm of mainstream awareness, it would perhaps be the GameStop short squeeze incident, which took place in January, 2021. It was a legendary battle between amateur investors coordinating via the r/wallstreetbets subreddit and a gaggle of multi-billion dollar hedge funds. These amateurs deliberately sent GameStop stock sky-high by buying it up, causing the mother of all short squeezes. The impacted hedge funds were going to zero at light-speed — until the establishment intervened on their behalf, and leaned on Robinhood to pull the plug on GameStop trading. Robinhood obliged — you don’t bite the hand that feeds you.

But this was the moment that the gloves came off. And it was hugely significant in terms of what it really meant: clued-up, disenfranchised, young digital natives were no longer interested in playing a game where they had zero chance of even making it to the finish line, let alone winning — so they were going to make up their own games. And that means that, from now on, they are going to assign value to whatever the hell they want to assign value to — irrespective of what Wall Street, or the hedge funds, or the demented gerontocracy on the hill thinks.

Crypto is philosophically aligned with that basic impulse. And it’s my firm conviction that this is a key ingredient that went into the cauldron from which this recent meme coin mania has emerged, as an entirely parallel new asset class (if you could call it that), completely outside of the boundaries of TradFi and even traditional crypto (which has to some extent already been co-opted by the ‘big money’). Meme coins, in other words, are the embodiment of this rebellious philosophy, which “treats objects of speculation as though they were intrinsically worthless”.

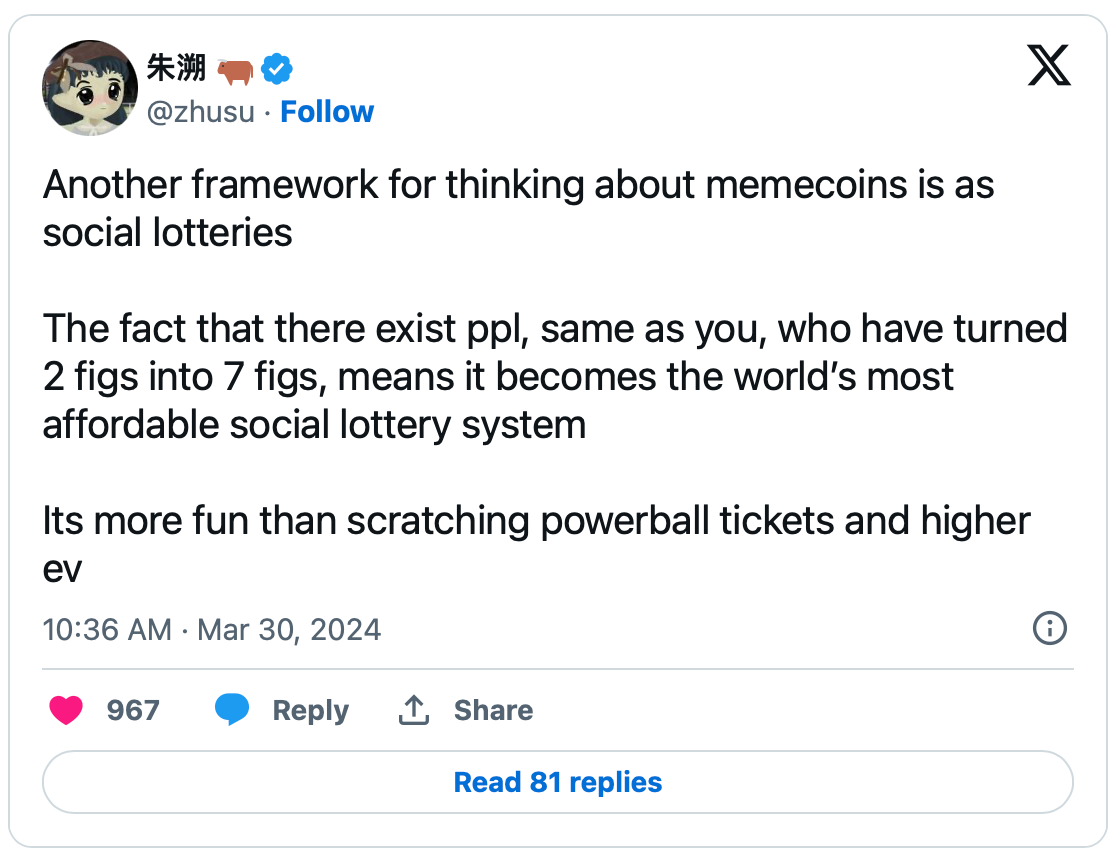

IT’S GAMBLING, BUT MUCH BETTER ODDS THAN THE LOTTERY

In America, lottery ticket sales are at an all time high. And it’s no secret that, as a general rule, how much a person spends annually on lottery tickets is inversely proportional to their net-worth. Poor people who are feeling desperate about their circumstances buy lottery tickets — not rich people in penthouses. The odds of winning the Powerball Jackpot are 1 in 292 million. “It could be you” doesn’t quite cover it in terms of the likelihood of winning. But when you’re in a desperate situation, what other hope do you have to cling to?

Well, putting money into meme coins must be considered gambling — it’s certainly not investing. And the chances of losing everything you put in (as is the case with playing the lottery) are very high. But the chances of winning the meme coin lottery are significantly better than traditional options — perhaps even by several orders of magnitude…

THE FINANCIALISATION OF MEMES IN THE NEW DIGITAL ECONOMY

In a previous article entitled Back to First Principles: Unpicking Web3, I highlighted the fact that ultimately “this whole crypto and Web3 revolution is about the digitisation of value — in the same way that the first wave of [internet] innovation was about the digitisation of information”.

Bitcoin was the foundational layer in this emerging movement to digitise value — specifically as a means of representing money and storing value digitally (in a decentralised format, beyond the clutches of the central bankers). Other subsequent layers have since been added, including smart contract platforms, new token standards, DeFi protocols, blockchain oracles and much else besides. All of this stuff could be equated to the railroads or the superhighways being built out as the foundations for the next (value-based) layer of the internet — in other words the infrastructure on which everything else will run.

But the infrastructure for what exactly?…

Well, one of the next phases in this process is the financialisation (or tokenisation) of what we now call “content” in the world of Web 2.0. It began in earnest with the arrival of NFTs — and the physical ownership (property rights) of digital artefacts and collectibles that they bestowed.

So, in this context - i.e. in the context of the creation of a new Internet of Value - should we really be surprised that memes have themselves become tokenised and assigned tradable, exchangeable value by market participants?

I would argue that memes are such an important part of the online world that meme coins are in fact an inevitable outcome of what’s been happening in crypto. Rather than being a malodourous aberration, they are an entirely logical consequence of creating an effective, permissionless system for tokenising value. Meme coins, in other words, are a feature of this new paradigm — not a bug. Instead of dismissing them outright as meaningless digital geegaws, we should perhaps see the incredible success of meme coins as evidence that the so-called Internet of Value actually exists — that it’s alive and kicking!